Tesla and the Fickle Magic of Sentiment

One challenge associated with expounding on events is having to choose from a multiplicity of subject matter. On any given day — today, for instance — I could take this vehicle and drive it in any of several directions.

But since I’ve invoked a driving metaphor, let’s go with Tesla’s faltering performance on the stock market. Given the “best buddy” relationship that Musk allegedly has established with the self-proclaimed King of America, Donald Trump, many market observers expected Tesla and other Musk companies to benefit enormously from the current administration.

Tesla, however, hasn’t enjoyed the benefit that pundits expected, though I would argue that Space X, Musk’s private concern, is well placed to reap immense rewards from the Trump presidency. I don’t think Space X is getting to Mars, but that doesn’t matter because Mars is not where the money is; and make no mistake, Musk is mostly about money, and, by association, power. Money and power go together like chocolate and peanut butter. Money and power are practically conjoined, the former often merging ineluctably with the latter. Money can buy influence — it invariably does — and the more venal the politician, the more influence the donor (political investor) can buy.

If I might digress briefly, we also see that Bitcoin, and cryptocurrencies more generally, have not received the sort of boost that the Trump presidency was expected to provide. That could change; there’s still time, of course, but Trump and his team appear more concerned about shoring up the American dollar against whatever the BRICs nations might be considering as a reserve-currency alternative to the greenback. Bitcoin and crypto are taking a back seat, and it could stay that way for a while.

As for Tesla, I’ve been fascinated with its outsize market valuation for a long time. Tesla stock’s imperviousness to fundamentals, or to any other form of objective reality, is instructive, for it reveals that irrationality often overtakes rationality in the realm of the public markets. Even Wall Street analysts understand that Tesla is driven by belief and sentiment rather than by fundamentals and hard reason, as this quote from a recent Bloomberg article makes evident:

“The real difficulty with any stock that is as richly valued as Tesla is to be able to call a floor,” said Steve Sosnick, chief strategist at Interactive Brokers. “Since Tesla has defied conventional valuations for so long, a bottom is more about investor sentiment than the normal metrics that value investors might use.”

Our Murky Motivations

If normal metrics, things that a reasonable human being might agree are important criteria, don’t matter, then what does?

Well, this is where the discussion of Tesla as a stock leads us to bigger questions, some of which have unsettling answers.

For example: In a philosophical sense, do we really understand why we do anything? Can we break down our actions and trace them back to purely logical or reasonable motives? Whenever you’ve done something particularly baffling and inexplicable, somebody has probably asked, often rhetorically, “What were you thinking?”

If you were to answer that question honestly, you’d struggle to articulate an intelligible response, because your actions likely weren’t guided and informed by rigorous logic or pure reason. We do irrational stuff all the time, and we do so without truly understanding why we’re doing it. This is another reason why artificial general intelligence (AGI) will never fully replicate human behavior or intelligence. There’s a lot happening in your mind, and the mental waters are deep and turbid.

I should get back to Tesla, though. The year is young, but Tesla stock hasn’t fared well in 2025. Year to date, Tesla shares are down about 25%, and the shareholding natives are getting restless. Some are demanding accountability from nominal CEO Elon Musk, who, let’s face it, seems to have spread himself a bit thin. On Musk’s own social-media soapbox, X, disgruntled Tesla shareholders expressed their dissatisfaction with the Tesla boss. This gem, directed at Musk, was noted in a Fortune article published earlier today:

“Please share five things you did for Tesla shareholders this week,” celebrity photographer Jerry Avenaim posted on Wednesday, with a graph showing the poor performance of the stock. “Or are you working remotely? Asking for all of us.”

What Have You Done for Us Lately?

The jibe, of course, alludes to the relentless interrogation and sacking of federal government employees that Musk has pursued under the aegis of his Department of Government Efficiency (DOGE, get it?), which recently demanded that government employees working in multiple agencies and departments specify five things they’ve accomplished during the workweek. Turnaround, as they say, is fair play, so Mr Avenaim and other Tesla shareholders are well within their rights to ask Musk to enumerate what he has done in the past week for Tesla and the company’s shareholders.

Could Musk — who ostensibly runs several other companies, shares inchoate thoughts relentlessly and around the clock on X, and now rules the land of DOGE — actually have any time left in the day or week to perform work for Tesla? I think it’s a fair question for Tesla shareholders to ask. Another fair question, one Tesla shareholders should perhaps be asking of themselves, is whether their sentiment-based valuation of the company is susceptible to a significant reset?

The thing about sentiment is that it can change in an instant. You never know when the worm will turn. You feel good about somebody or something one minute, and then, as a result of something that happens or something that somebody says or does, your perspective changes, sometimes dramatically.

How do you account for the mercurial nature of sentiment, especially in a market context? You need to be constantly mindful not only of own subtle — and sometimes not so subtle — shifts in sentiment, but you also need to be cognizant, on some mystical plane, of vacillating sentiment among other shareholders. When, for example, does the herd’s collective sentiment shift the balance dramatically from a favorable view, bestowing an inflated valuation, to a negative majority judgement, with disillusioned shareholders sprinting for the exits amid a cratering share price?

Sentiment is quicksilver. You never know what might trigger its inherent volatility, and you need know when the spark will turn to flame. When sentiment shifts sharply from favorable to unfavorable on a stock, it’s as if a veil, which maintains the suspension of disbelief, suddenly drops to the ground, and shareholders realize that the company in which they’ve invested is run by mere mortals, not by demigods or superheroes. At that point, fundamentals, previously dismissed as irrelevant to the exceptional set of circumstances surrounding the preternatural company in question, become relevant again.

Belief and sentiment often overtake rational analysis, but the latter always makes a reappearance, if only to recalibrate or refocus belief and sentiment around a different proposition.

The Illusionist’s Art

By any objective measure, Tesla shares are beneficiaries of a lot of faith, misplaced or otherwise. Whether you believe the faith in Tesla shares is justified depends not on fundamentals but on your sentimental assessment of Tesla’s valuation, now and in the foreseeable future.

The Bloomberg article provides insight into how untethered Tesla shares are from the banal ground of fundamentals:

For now, few catalysts for a rally are apparent. Analysts do not expect a meaningful update on the company’s plan for a fully self-driving vehicle any time soon. A competitor, China’s BYD Co., earlier this month said it planned to enable advanced driver-assistance features in almost all future models at no additional cost. Musk’s preoccupation with politics has also worried investors who would like to see him spend more time running the EV maker.

The stock’s high valuation is another reason for caution. Tesla shares trade at 92 times forward earnings, compared to 21 times for the S&P 500 and an average of 28 times for Tesla’s mega-cap peers. Its recent decline has come amid a slide in the broader market that has pulled the S&P 500 down some 5% from a record high hit this month.

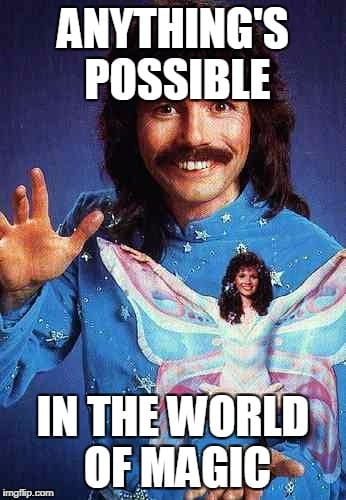

Elon Musk is a nonpareil illusionist, a Doug Henning of the corporate realm. He has convinced a lot of people that Tesla is something it is not. Through his masterful conjuring and deceptive sleight of hand, Musk has persuaded his acolytes, many of whom have become Tesla investors, that Tesla is not really an automotive company, but is instead an AI company. Therefore, what he wants for Tesla is an AI valuation, not an automative valuation. Apparently, the market has acceded to his wishes, at least for now.

But, come on, people: When you buy a Tesla, you’re buying a car or a truck — an electric vehicle, sure, but a vehicle all the same. The Tesla arrives replete with electronics, computer hardware, and a wealth of software, but it’s still a vehicle. Its practical utility derives from its function as a vehicle. Besides, the vast majority of vehicles, electric or otherwise, are similarly packed with electronics, hardware, and software. Moreover, as the Bloomberg piece and other recent reports, including one from the Wall Street Journal, have explained, Chinese EVs are arguably more technological advanced, invested with a greater wealth of automated intelligence, than are Teslas.

Elon Musk has cast a spell over Tesla shareholders, but the incantations and the magic depend on the audience’s suspension of disbelief. At times, it seems that Musk himself is trying to break the spell.

Arguably one of his biggest acts of self-sabotage was his decision to involve himself in partisan politics, as the leader of DOGE in the Trump Administration. Musk’s embrace of, and acceptance within, the Trump Administration is inherently contentious and highly divisive. It’s the sort of thing financial or industrial magnates typically refrain from doing, because getting involved with politics necessarily alienates a significant part of the market that buys your product or service.

Already we see that many Tesla buyers have soured on the brand, and on Musk personally. The problem for Tesla is that Musk and the company’s brand are so closely interrelated as to be inseparable. For a while, when Musk as deemed a genius by the business media, Tesla shareholders were content to accept the indivisibility Musk and Tesla. Now, though, as consumer animus toward Musk results in plummeting sales of Tesla vehicles in Europe and elsewhere, Tesla shareholders are afflicted by something akin to buyers’ remorse.

Can Musk the illusionist keep reality at bay? Market sentiment, which can be favorable and unfavorable, will render its own verdict.

It’s Friday, of course, so I’ll attempt to provide a suitable musical accompaniment for today’s post. The crack of the drums on this one brings it home at the end.

John Cale: Magic & Lies